Tax Advantages

To maintain its world-class business climate, Butte Silver Bow offers relocating and expanding businesses a wide range of benefits, including:

- Incentives that provide financial assistance

- Streamlined regulatory processes

- Low taxes

- Innovative and highly ranked workforce development support

The advantages of doing business in Butte carry over to the personal side, where the cost of living in Butte is affordable giving companies an added enticement in recruiting executives, professionals and technology workers.

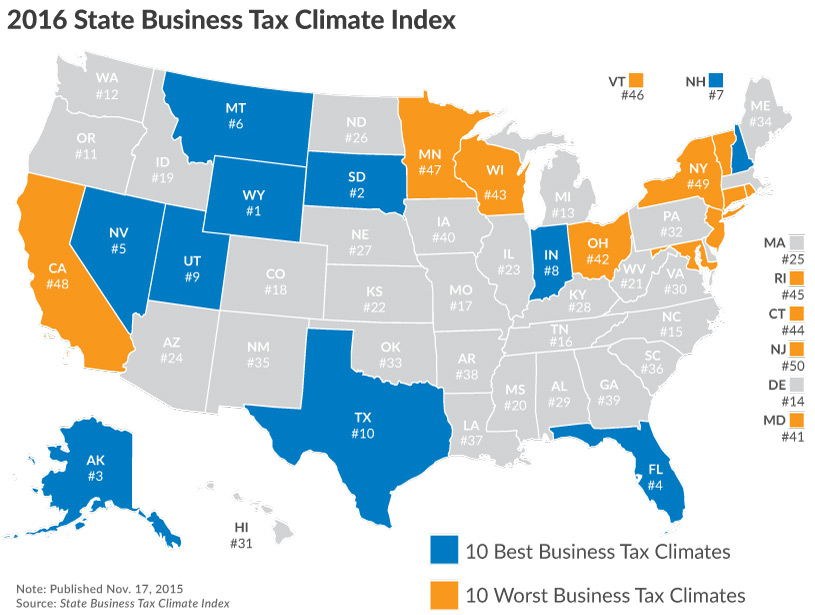

A stable and highly favorable tax climate enhances profitability for a wide variety of businesses looking to grow and prosper in a Butte, Montana location. Montana Tax Structure Ranks as One of the Best for Businesses in the Country. In fact, Montana ranks 6th in the Tax Foundation’s State Business Tax Climate Index for 2016. Click to visit www.taxfoundation.org for more information.

NO SALES TAX AND NO INVENTORY TAX

Everyone loves our tax climate because we have no sales tax and no inventory tax! The lack of a sales tax and inventory tax also reduces the tax cost of purchasing equipment and machinery. In fact, the Tax Foundation ranks Montana in the Top 10 for both mature and new retail establishments. Visit www.taxfoundation.org for more information.

CORPORATE LICENSE TAX

Montana ranks third for mature corporate headquarters with a tax burden nearly 40% below the national average. The lack of a state sales tax is one of the contributing factors in this top ranking. The operation also has a modest income tax burden due to the state’s relatively low 6.75 % corporate tax rate and 3 factor apportionment formula. For more information view the Montana Department of Revenue Corporation License Tax pdf at www.revenue.mt.gov

INDIVIDUAL INCOME TAX

In Montana, income is taxed according to a graduated rate structure with rates ranging from 1% to 6.9% of taxable income. Like most other states, Montana’s income tax substantially relies on federal tax code. Taxable income is derived from gross income by making certain adjustments and taking a variety of allowable deductions and exclusions. Montana residents are taxed on all income, regardless of source, with the exception that Montana law exempts certain types of income. Part-year residents and nonresidents are taxed on all income derived from or connected to, Montana sources. Additionally, part-year residents are taxed on all non-Montana source income generated during or attributable to the period of the tax year in which they resided in Montana.

PROPERTY TAX

In Montana, most real estate, improvements, and personal property are appraised and taxed. Property tax liability is calculated based on property, tax rates and calculation formulas established by the legislature. Currently, eleven classes of property are taxed. These property classes include metal and non-metal mines; agriculture land; residential, commercial, and industrial land and improvements; business equipment; forest land; various utilities and more. Property owned by companies that is single and continuous and is in more than one county (such as railroads, telecommunications, electric utilities and pipelines) is centrally assessed. The Montana Department of Revenue provides detailed information on the eleven different classes of property and how those taxes are assessed. The following calculations are used to determine general property tax: Value X Tax Rate = Taxable Value and Taxable Value X Mill Levy = General Property Tax

Montana Offers Tax Incentives On…

- Alternative Energy Production

- Biodiesel/Bio-lubricant Production Facilities

- Biodiesel Blending and Storage

- Capital Gains and Dividends from Small Business Investment Company

- Contractors’ Gross Receipts

- Empowerment Zone

- Corporate Energy Conservation Investments

- Film Employment Production and Film Qualified Expenditures

- Geothermal Systems

- Historic Building Preservation

- Research and Development Activities

- Infrastructure User Fees

- Mineral and Coal Exploration

- New and/or Expanded Manufacturing Industry

- Oil Seed Crushing Facility

- Recycling

- Research and Development Firms Tax Exemption

For more information regarding any of these programs please view the pdf at, www.revenue.mt.gov